by dmccarron | Dec 1, 2015 | Select Engagements

CCA serves in a financial advisory capacity to the Board of Directors of a community based not-for-profit skilled nursing provider in the Greater Boston market area.

Recent initiatives have included the introduction of a distinct short-stay unit of operations to accommodate increasing post-acute and rehabilitative service programing. This initiative was undertaken by reducing licensed bed capacity to accommodate the conversion of an existing long-term care unit to establish 20 private room accommodations; introduction of common area amenities; and reconfiguration of more customized resident support areas. The unit renovation and conversion was funded through extended capital provided by existing lenders interests.

The strategic business plan ideally introduces more distinct and customized post-acute programming responsive to market trends and demands of emerging ACO providers as well as other primary referral sources.

by dmccarron | Mar 11, 2015 | Select Engagements

CCA recently completed a project development and financing transaction for a community not-for-profit skilled nursing and assisted living provider located in the Seacoast market of New Hampshire. The transaction involved securing $16MM in development financing from a commercial healthcare lender.

The project contemplates an expansion of existing operations to accommodate 52 added units of assisted living and memory care programming for the provider. Serving as business and financial advisors, CCA provided full scope services to originate, plan and close the project transaction. The strategic business plan ideally leverages existing operations while revitalizing and expanding existing asset interests to strengthen and broaden continuing operations.

by dmccarron | Dec 31, 2014 | Select Engagements

CCA has served in business and financial services capacity to a community not-for-profit senior campus provider of skilled nursing and assisted living operations located in Cambridge, MA.

CCA has served in business and financial services capacity to a community not-for-profit senior campus provider of skilled nursing and assisted living operations located in Cambridge, MA.

Recent initiatives have included the completion of $20MM in combined recapitalization transactions with a single regional commercial healthcare lender. Proceeds of the transactions were utilized to refinance and retire existing debt obligations through a private placement revenue bond issue and term debt credit facility; early redemption of a prior revenue bond issue; discounted settlement and retirement of multiple subordinated debt obligations; purchase redemption of interests associated with terminating a tax credit partnership; and funding of new endowment and operating reserve accounts for continuing operations.

The resultant transactions materially improve the capital structure of the company through realization of liquid collateral associated with prior debt obligations as well as a material increase in unrestricted net assets represented by the discounted settlement and elimination of subordinated debt. The renewed and strengthened capital structure ideally supports new programming initiatives as well as prospects for emerging fund raising activities for continuing operations.

by dmccarron | Jun 8, 2014 | Capital Care Associates, Select Engagements

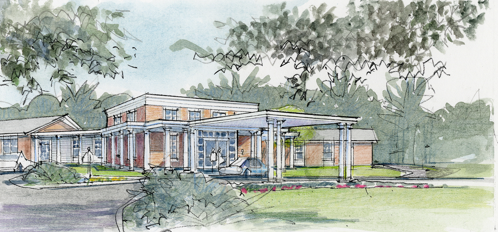

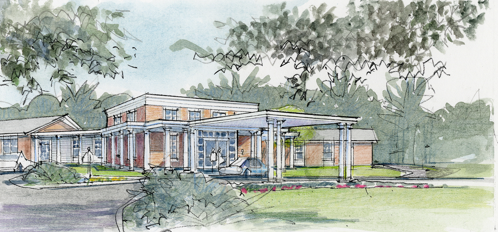

CENTRAL MASSACHUSETTS – CCA served in a business and financial advisory capacity to a regional multi-facility skilled nursing provider in Central Massachusetts. Recent initiatives have included the introduction of a senior living campus development surrounding its primary skilled nursing property.

To date, CCA has secured $30MM from a regional commercial healthcare lender to fund the initial phases of the campus development. Proceeds of the financing transactions have been dedicated to refinance existing asset interests while completing a major renovation and 40,000 square foot expansion of the skilled nursing property. The full scope renovation extended to reconfiguring all existing units; establishment of substantially all private room accommodations; expanded therapy service areas; replacement kitchen; and improved customization of resident care and common areas. The expanded property allowed for the planned merger of an existing respiratory long-term care program unit operating in a leased property.

Concurrent with the renovation and expansion project, funding was utilized to develop an adjacent new Medical Office Building representing 36,000 square feet of new program space. The MOB is currently occupied by an anchor tenant that provides a wide array of both physician specialty offerings and extensive ancillary services. Continuing initiatives are planned to introduce added senior living product and program presence for the campus.

CCA has served in business and financial services capacity to a community not-for-profit senior campus provider of skilled nursing and assisted living operations located in Cambridge, MA.

CCA has served in business and financial services capacity to a community not-for-profit senior campus provider of skilled nursing and assisted living operations located in Cambridge, MA.